CX and Impact on Customer Lifetime Value

Customer Experience and Impact on Customer Lifetime Value!

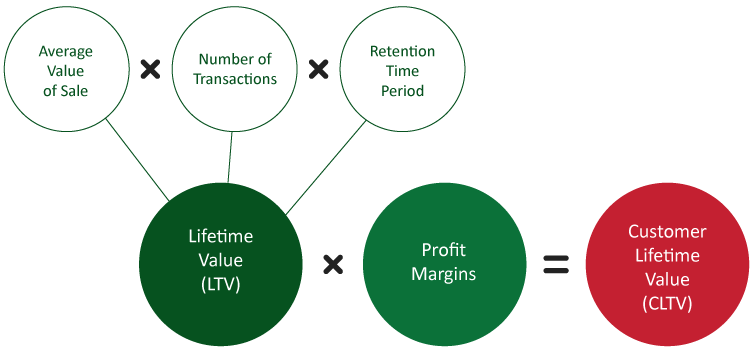

Customer Lifetime Value

Customer lifetime value is a very valuable metric and as per Harvard Business Review (HBR), acquiring a new customer is 5 to 25 times more expensive than retaining an existing customer (as it saves the marketing cost in acquiring the new customers). Once companies start calculating the CAC (the cost to acquire a customer) which will be the summation of sales and marketing cost, the cost to organise events and branding costs will far exceed the retention cost.

CLTV will enable the company to assess the sales value and evaluate the profitability derived from a returning customer. As businesses grow, companies will build up a large database of customers and it will be beneficial to know the CLTV of customers having high profitability over a period of time. Such customers would continue to be a healthy source of revenue for the company.

Analysis of such customer-centric data may lead to a situation in the future when the company may wish to run special loyalty programs to targeted customers as a gesture of gratitude. The amount spent on such events will take into account the marketing cost and the concessions and evaluated against the CLTV. Thus, pleasant customer experience is seen to be an important attribute for a differentiated business of the future.

Example: Van Heusen (Source: Anarock.com)

Van Heusen’s Power Club is a loyalty program with three categories of memberships such as Classic, Silver, and Gold, depending on a customer’s shopping profile. Members can earn reward points based on the value of the purchase and are entitled to benefits like in-store personal assistance, valet facilities at select locations and advice from in-store stylists on special occasions.

Gold and silver members have privileges of access to exclusive sales previews, invitations to fashion evenings and home delivery of altered garments. Gold members are entitled to privileges like exclusive trail rooms, pick-up and drop facility for garments exchanges and invitations for an exclusive preview of new collections. This loyalty program is intended to achieve the long lifetime value of a customer. As the members in these three levels grow correspondingly, the CLTV will also see an increase over time. The above example shows how a company differentiates its customers on the basis of the average value of sales correspondingly calculating CLTV to offer appropriate value propositions.

Online players have also started their own membership programs to increase retention period eventually targeting to increase CLTV. Amazon which is a multinational e-commerce giant has started its prime membership program with a nominal annual fee, where the member gets unlimited free two-day shipping on million items as well as perks such as streaming services and Prime day sales offers. Its strategy is to become a differentiator and achieve a competitive advantage as the industry offers similar products at the same price point. Hence, a loyalty program will not only become a differentiator but also increase the retention period of an average customer.

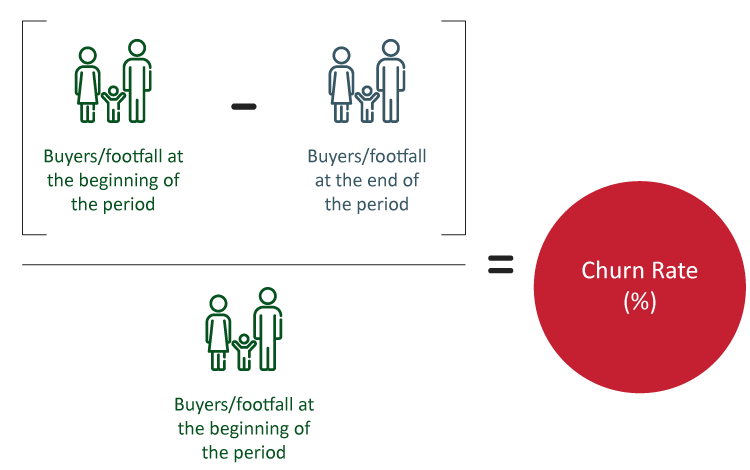

Churn Rate

Churn rate which is also known as attrition rate is the percentage of buyers or visitors who stop visiting a particular mall or a store For a mall or a store to grow. It is important to maintain the footfalls and reduce the attrition rate of the existing customers. However, in retail, the number of buyers in a year or footfalls to a mall along the year depends on the external factors with seasonality effect and it fluctuates across the year. But the churn rate can be calculated on an average basis from year to year. An average number of buyers or footfalls to a mall in a particular year can be compared to the present average and hence the corresponding churn can be calculated. Hence, companies should focus on curtailing the chum rate and correspondingly identify the reason why a customer is switching to its competition.

What are some of the approaches taken by malls to reduce the churn rate?

1) Suitable tenant mix

Due to the failure of a few malls which had inappropriate tenant mix, the newer malls are changing their tenant mix due to the changing consumer dynamics. Malls have understood the changing consumer preference, the emergence of e-commerce and online retailing and hence space was allocated for commoditised retail like mobile and electronics was reduced. Categories such as books and music have also seen a reduction in space as they can be conveniently purchased outside. According to an industry survey, the average number of electronics stores in malls has gone down from 9% in 2014 to 3% by 2016. DLF Mall of India has allocated nearly 40% space for entertainment which is nearly double than the prevailing practice.

Simon Property Group (SPG), a real estate giant with headquarters in Indianapolis, has relied on aggressive deal-making and savvy property management to bolster its position as the largest US operator and developer of shopping malls. SPG’s U.S portfolio includes 108 malls, most of them high-grossers like Roosevelt Field, and 72 discount outlet centres. That adds up to real estate worth USD 110 billion. Simon understood that hundreds of shopping centres across the US are facing obsolescence, abandoned by shoppers who are going online or getting choosier about where they shop. Therefore, it started to rethink what kind of stores fit in a mall and their existing spaces are being re-purposed for occupants like Cheesecake Factory and fast-fashion retailers Primark. Simon has added 200 restaurants in its properties in the past five years and other non-retail spaces such as movie theatres and health clubs are also proliferating. According to SP6, such reinventions are necessary which will pay off in the future and it also says that they are always on their toes to reinvent their properties to offer that extra edge to provide differentiation.

2) Personalized shopping experience

Like e-commerce practices, malls also want to know their customers better as the success model of e-commerce is tracking every customer at an individual level and giving suggestions. Malls are trying to apply that methodology to reduce churn and increase footfall. Mumbai‘s Viviana mall is trying to personalise the mall experience by engaging its visitors through social media every year and conducting customer surveys in the mall. Malls are trying to create a huge shift from mass marketing to individual marketing.

While CLV is a great concept to assess the profitability of your CX efforts, it should not be the only parameter that an organization must focus on. The biggest problem with how CLV models are actually used is that they tend to deny the very idea that marketing works (i.e., that marketing will change customer behaviour). Low-value customers can be turned into high-value customers by effective marketing. Many CLV models use incorrect math in that they do not take account of the value of a far greater number of middle-value customers, over-prioritizing a smaller number of high-value customers. Additionally, these high-value customers may be saturated (i.e., not have the ability to buy any more coffee or insurance), maybe the most expensive group to serve, and maybe the most expensive group to reach by communication. The use of survey data is a viable way to collect information on potential customers.

“Shopping today is not just about buying a product for a customer. It is an entity of indulgence and well-being. Though online shopping platforms have added ease and convenience to the shopping experience, offline shopping adds leisure and entertainment to their overall experience.”

-Anuj Puri (Chairman – Anarock Property Consultants)